trust capital gains tax rate 2021

Capital gains and qualified dividends. It continues to be important to obtain date of death values to support the step up in basis which will reduce the capital gains realized during the trust or estate administration.

Capital Gains Tax Calculator 2022 Casaplorer

Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates.

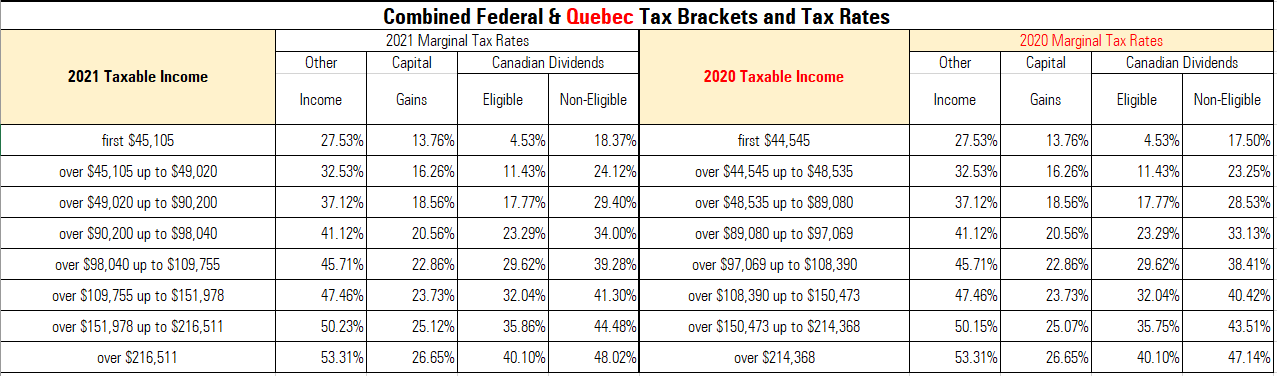

. For tax year 2021 the 20 rate applies to amounts above 13250. Trust tax rates are very high as you can see here. The tax rate works out to be 3146 plus 37 of income over 13050.

2021 Ordinary Income Trust Tax Rates. However long term capital gain generated by a trust still maxes out at 20 plus the 38 when taxable trust income exceeds 13050. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income.

IRS Form 1041 gives instructions on how to file. 2022 Long-Term Capital Gains Trust Tax Rates. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

For more information please join us for an upcoming FREE seminar. Table of Current Income Tax Rates for Estates and Trusts 202 1. Learn How EY Can Help.

R2 million gain or loss on the disposal of a primary residence. If you have additional questions about how capital gains taxes impact an irrevocable trust contact the North Andover trust attorneys at DeBruyckere Law Offices by calling 603 894-4141 or 978 969-0331 to schedule an appointment. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

The following are some of the specific exclusions. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for more than a year. It applies to income of 13050 or more for deaths that occurred in 2021.

Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time. Events that trigger a disposal include a sale donation exchange loss death and emigration. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a 1041 tax return.

97 rows Federal tax rate for long-term capital gains assets held for more than one year and qualified dividends for individuals with taxable income between 80001 and 496600 joint and 40001 and 441450 single in 2020 and between 80800 and 501600 joint and 40400 and 445850 single in 2021. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year.

Compare these thresholds to those for single filers where the top marginal tax rate begins after reaching 523601 of ordinary income more than a 500000 difference. Contact North Andover Trust Attorneys. For trusts in 2022 there are three long-term capital.

Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits on the sale of a home. The 0 and 15 rates continue to apply to amounts below certain threshold amounts. The highest trust and estate tax rate is 37.

The maximum tax rate for long-term capital gains and qualified dividends is 20. Short-term gains are taxed as ordinary income. As of 2021 the top tax rate of 37 on ordinary income eg interest nonqualified dividends and business income begins after reaching a threshold of only 13051.

Qualified dividends and capital gains on assets held for more than 12 months are taxed at a lower rate called the long-term capital gains rate. 0 2650. In 2021 the federal government taxes trust income at four levels.

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. Ad Estate Trust Tax Services. 3 rows The maximum tax rate for long-term capital gains and qualified dividends is 20.

The 0 rate applies to amounts up to 2700. 20 for trustees or for personal representatives of. Explore The Top 2 of On-Demand Finance Pros.

3 rows The maximum tax rate for long-term capital gains and qualified dividends is 20. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act.

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

How To Avoid The Capital Gains Tax Loans Canada

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Pin By The Taxtalk On Income Tax Income Tax Capital Gains Tax Capital Account

Capital Gains Tax In Canada 2022 Turbotax Canada Tips

Pin By Larry Oliver Reed On Investing Investing Income Tax Brackets Capital Gains Tax

Capital Gains Tax On Shares In Australia Explained Sharesight

Reporting Capital Gains Dividend Income Is Complex Morningstar

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Reporting Capital Gains Dividend Income Is Complex Morningstar

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Capital Gains Tax What Is It When Do You Pay It

Understanding Taxes And Your Investments

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

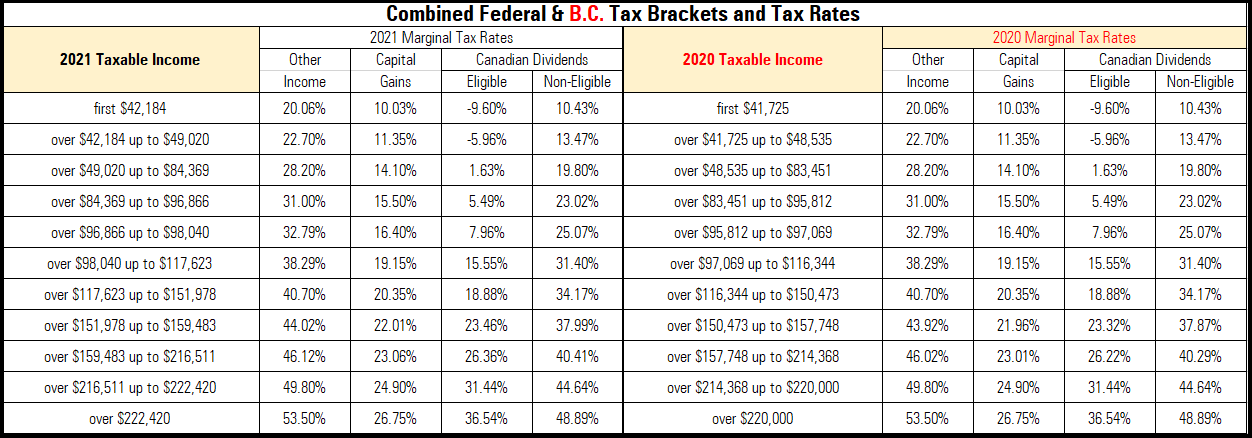

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

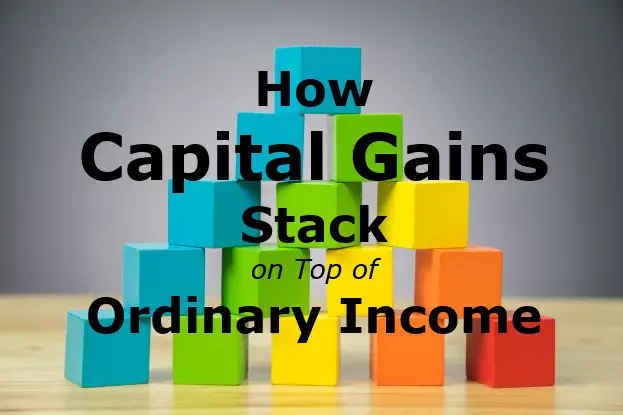

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician